Contemporary Information Corp is a Duluth, Georgia based provider of criminal and housing public records that has supported landlords, rental housing companies, and insurance organizations for nearly four decades. Established in 1986, Contemporary Information Corp has built its reputation on delivering accurate, Fair Credit Reporting Act compliant data that helps housing professionals make informed decisions in a rapidly changing real estate environment.

Led by chief executive officer William Bower, president Ryan Green, and chief financial officer Sabrina Bower, Contemporary Information Corp maintains one of the industry’s most extensive databases, comprising more than 30 million housing court records and nearly one billion criminal records. Its proprietary heuristic matching methods and regulatory filtering tools reinforce data reliability and compliance.

As multifamily markets evolve under pressure from economic, regulatory, and demographic shifts, Contemporary Information Corp’s emphasis on data integrity and regulatory alignment supports property owners and operators navigating new market realities. The company also remains active in community support initiatives, reinforcing its long standing commitment to responsible business practices alongside industry leadership.

Trends Impacting Multifamily Property Markets in America

Rising costs, new regulations, and evolving tenant expectations are just a few of the trends influencing America’s real estate markets, many of which are informed by the latest advances in technology. Operators in the nation’s multifamily market must stay abreast of these changes to remain competitive.

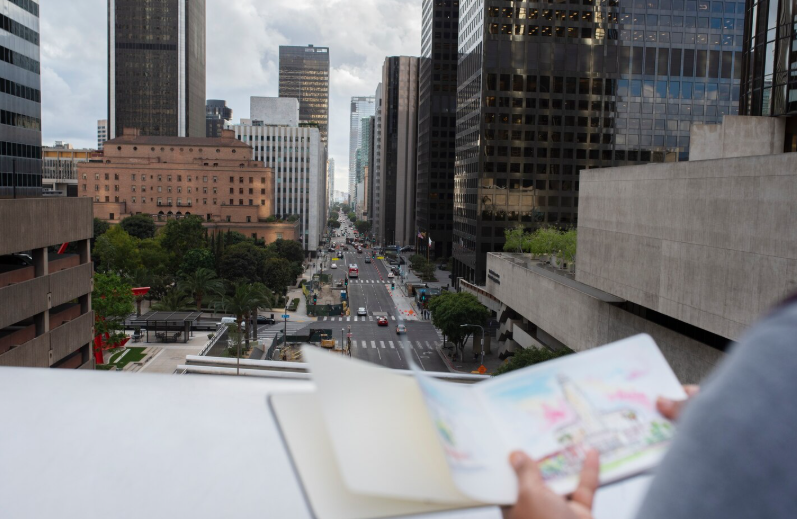

Office-to-residential conversions are among the key trends shaping the nation’s multifamily market in 2025 and beyond. While remote work trends have stabilized in recent years, numbers indicate that Americans prefer remote or hybrid positions. Regardless of how future return-to-work mandates play out, many office buildings in major cities remain vacant. Cities such as San Francisco and New York have attempted to address this issue and the housing crisis by converting vacant office buildings into apartment complexes.

In 2025 alone, NYC developed more than 8,300 new residential units from office building conversions, up nearly 60 percent from 2024. However, investors must keep their expectations in line with reality. While these conversions provide many unique opportunities, they also present several challenges. Many office buildings are not designed for residential use, for example, and property owners may need to invest in plumbing, lighting, and completely redesigned floor plans, to say nothing of complex zoning laws.

These challenges may prove worth the headache considering the skyrocketing costs of construction and insurance, another critical trend affecting America’s multifamily market. Rising construction costs have defined the national multifamily market for several years, but the pressure intensified in 2025. Inflation, tariffs on various building materials, and supply chain disruptions have combined to drive prices even higher than expected, resulting in fewer multifamily housing units available and rising rents for those units.

Increasing insurance costs have further complicated affordability issues, particularly in disaster-prone regions of the country. In Florida and California, for example, insurance premiums for multifamily properties have increased by approximately 300 percent since 2020. This makes it extremely difficult for property owners to offer units at affordable prices. With this challenge in mind, many multifamily investors have moved away from high-risk markets.

On a similar note, apartment complex owners and other operators in the multifamily housing market have turned their attention to sustainable construction and disaster-resilient housing. Even in average-risk regions, climate change is causing more wildfires, severe storms, and other damaging weather events than ever before. As a result, the market has placed a greater emphasis on “passive house” design, a design philosophy defined by stronger insulation, strategic ventilation, and other low-energy design features.

Developers have combined passive house design with disaster-resistant building materials, such as flood-proof foundations, impact-resistant windows, and reinforced concrete. Property owners can reduce energy expenses and limit damage by following these design principles, while also benefiting from federal tax incentives for properties that meet ENERGY STAR and Zero Energy Ready Home standards.

Finally, multifamily investors and property owners should consider the rising trend of co-living and intergenerational housing situations. The ongoing challenge of affordable housing, particularly in large metros, has led to an influx of co-living spaces. Key features of these spaces include shared kitchens and common areas for residents renting private bedrooms. These spaces are especially popular among younger generations and remote workers.

Intergenerational housing is a similar trend, defined by younger renters moving in with older homeowners. With these trends in mind, property owners should prepare to adjust to new leasing models and more community-focused management strategies.

About Contemporary Information Corp

Contemporary Information Corp is a Duluth, Georgia based provider of housing and criminal public records founded in 1986. The company supports landlords, rental housing operators, and insurance organizations with Fair Credit Reporting Act compliant data drawn from more than 30 million housing court records and nearly one billion criminal records. Led by William Bower and Sabrina Bower, Contemporary Information Corp combines proprietary data refinement methods with rigorous compliance standards to deliver reliable information for informed housing and risk decisions.